Introduction

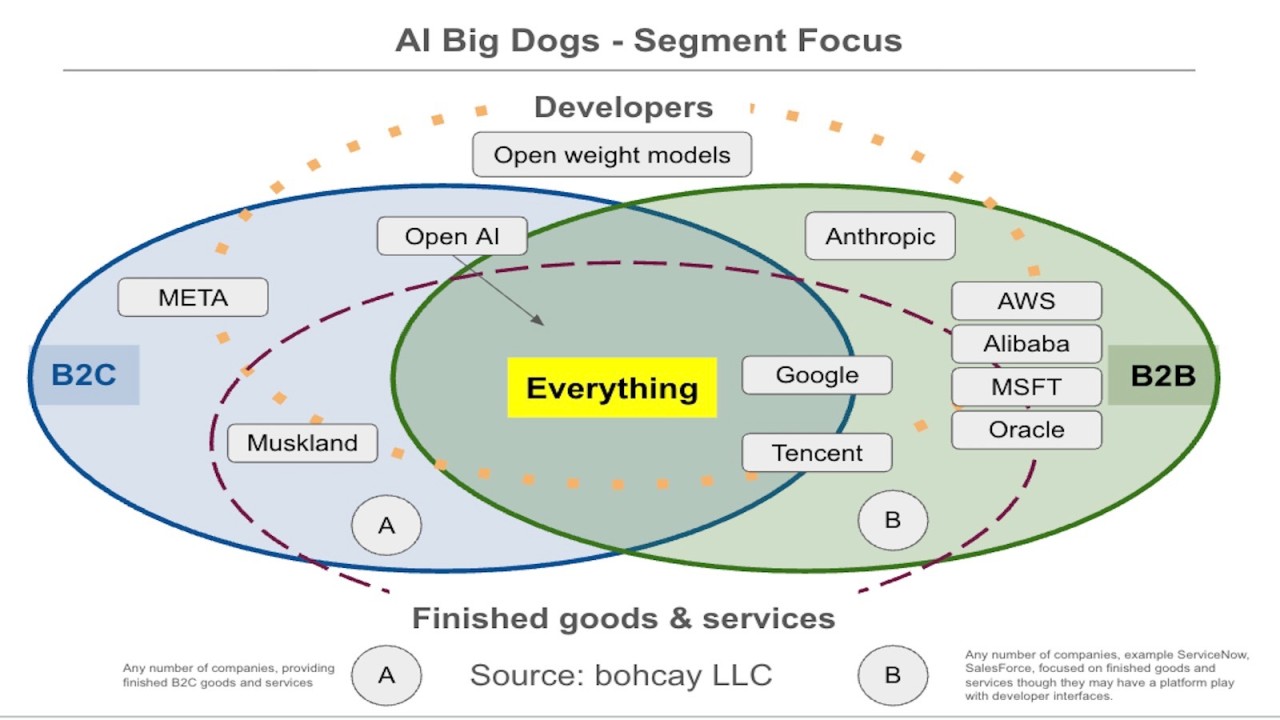

In a market changing so quickly strategists need multiple views of the "chess board." We need to know where players are focused, where they might go next, and where they face extreme headwinds. This analysis offers an initial framework for understanding these positions, with more iteration and refinement to follow.

The Basic Landscape

Infrastructure providers like AWS, Azure, and Google Cloud are fundamentally B2B, selling services to developers and businesses. Amazon itself is a consumer brand powerhouse, a discussion for another day.

Conversely, companies like OpenAI are consumer-first (rumored to have a 70/30 consumer/enterprise revenue split). Elon Musk's properties (Tesla, X, xAI) are defining post-Jobs consumer brands. Meta, a social king, remains consumer-centric, notwithstanding its advertising business.

A key theme in 2025 is defensibility. In the race to be the "everything" company (a role OpenAI seems to be auditioning for), are any applications truly safe? Strong B2B brands like Salesforce and ServiceNow are likely secure in the short term. However, many consumer applications face a threat from new startups, given the low barrier to entry for building and launching. Major application players still face the classic Christensen-style disruptive threat from below (overserving the market), but this is for now, a more subtle, medium to long-term risk.

(Note: Many brands, including the significant consumer brand Apple, have been omitted from this initial map for simplicity - future iterations may include them.)

A Note on Advertising

Meta and Google are often framed as direct competitors because of their massive advertizing businesses. While acknowledging that reality, this initial AI-centric analysis does not focus on that dimension.

B2B

While OpenAI loudly built a dominant consumer brand (ChatGPT is arguably the "Kleenex" of GenAI), Anthropic quietly cultivated a B2B brand focused on developers and knowledge worker productivity. Anthropic is currently centered on enabling automation rather than delivering finished consumer-facing goods.

AWS, Azure, and Google Cloud are the well-known titans. I've also included Oracle, as it is at least a route to market with a long history in business IT infrastructure. Chinese companies like Alibaba and Tencent (notable for also having WeChat consumer success) are on the map, but a full discussion of China's impact and positioning requires its own analysis.

B2C

Elon Musk's ecosystem ("Muskland") is a dominant force in B2C. While I've excluded entities like SpaceX, Starlink, and The Boring Company for simplicity, Tesla, X, and xAI represents one of the most compelling finished-goods-and-services companies of the post-Jobs era. Musk companies are finding increasing synergies at the AI-chip level, overall AI expertise, and more. Muskland is complex enough to require a standalone deep-dive.

Regarding Meta, more analysis is needed. Outside of advertising, I do not view Meta as a B2B heavyweight. While its Llama model was well-received at launch, the shine has worn off. It is used in benchmarks and research but has not captured developer mindshare in the same way Anthropic's models have. I will reserve further speculation until I've dug deeper.

The "Everything" Company

Having lived through multiple "God Box" cycles in different contexts, my default position is skepticism about companies trying to be all things to all people. However, when you are already the "Kleenex" of AI, why not swing for the fences?

If there is one company the market expects to take a swing at being the "everything AI company," it is OpenAI. It already has both business and consumer (70%?) revenues, massive brand strength, a custom chip deal with Broadcom, and strong developer usage. OpenAI is taking its brand out for a walk, anticipating a huge influx of capital when it eventually does an IPO. Just because this "everything" segment isn't crowded doesn't make it a good strategic choice, and it's certainly not an easy ambition. However, OpenAI is a leading candidate to achieve it.

Are there other candidates? Google has a great consumer brand via Search, strong AI models, financial muscle, and an increasing focus on its enterprise AI business. While it may not currently have the same "finished goods" polish as others, Google clearly intends to create its own AI applications. Definitely a company to watch.

Conclusion

As stated, this is an initial look at how companies are positioned in the AI landscape. More detailed research and thought will follow. This type of mapping is the bread and butter of strategy, and also mentally engaging in an industry this dynamic - changing from hour to hour.